The Wall Street Journal’s Your Money Briefing podcast recently reported on a benefit trend where employers are increasing 401(k) matches. Attracting and retaining workers is crucial for employers as the Great Resignation does not appear to be abating just yet.

Many corporate retirement plan advisors are starting to encourage their clients to consider increasing employer health savings account (HSA) matches. As HSAs enter the financial planning sphere in full-force, corporate retirement consultants are in an ideal position to help educate plan participants on the virtues of a sound HSA framework.

An Unparalleled Tax Gift

Favoring higher HSA matches over 401(k) is a way to ensure more spending power, now or in the future. HSA contributions are not subject to FICA withholding (the federal Social Security and Medicare tax). Employees are already 7.65% ahead of the game with an HSA contribution compared to a 401(k). A 7.65% head start may not evoke fist pumps, but it should get an approving head nod at the very least.

HSAs are also one of the only savings vehicles that yield a triple tax advantage. Contributions, growth, and withdrawals all avoid federal taxes provided the funds are spent on qualified healthcare expenditures. (Note: some states may tax investment income. HSA owners should consult their tax professionals.)

Stealth Emergency Accounts

Another Wall Street Journal podcast expands on the stealth emergency fund planning technique. Charles Forelle explains, “You can withdraw at any time from an HSA as long as you have medical expenses. The medical expenses don’t need to happen when you withdraw the money. If you are the organized sort and you save medical receipts, you can cash them out whenever you need money. All the money is tax-free”.

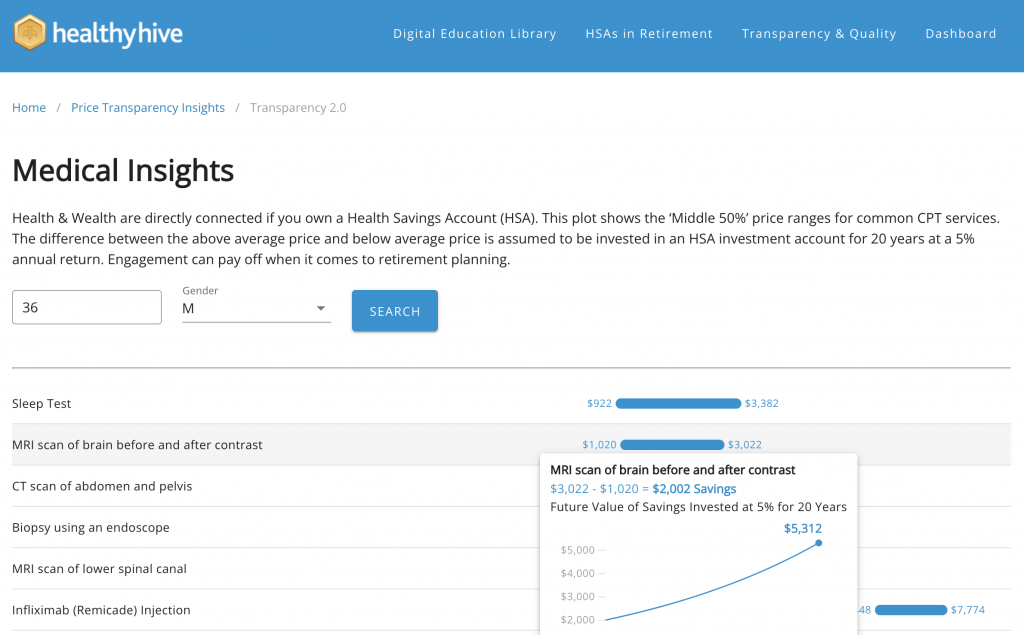

The emergency fund strategy is a subtle HSA feature. HSA owners that retain medical-related receipts for cash-pay services can reimburse themselves in the future. Currently, only the most savvy & affluent HSA users earmark a majority of contributions for investment while retaining receipts on qualified healthcare services. But as transparency tool adoption grows (to avoid overspending) in popularity with employers, future employee savings opportunities should increase.

It Starts with Education

Increasing HSA matches will certainly go over well with employees. However, an expensive MRI could wipe out an entire year’s savings. When it comes to avoiding overspending from their HSAs most employees need to fend for themselves. Employers that invest in HSA education can help workers stretch their HSA balances. Our HSA education videos start with the basics and progress to consumer education tips. Coupling education with increased matches can unlock significant value for both employees and employers.

HealthyHive provides users with insights about potentially high out-of-pocket expenditures based on their age and gender. The tool expresses potential future value of invested savings derived from seeking a more competitive price for healthcare services. The objective is to provide employees with needed incentive to stretch their HSA balances. Retiring earlier should be at the top of anyone’s list!

Companies also stand to benefit from a comprehensive HSA education program. Improved employee financial health can drive more productivity. Furthermore, self-funded health plans stand to benefit immensely from better HSA education. HealthyHive’s Enterprise tier can recycle self-funded claims data to provide employees with up-to-date provider listings and historical prices.

Please contact your retirement plan consultant or us directly if you would like to learn more about our comprehensive Employee HSA Education offering. HR professionals can learn more at https://www.healthyhive.com/hrprofessionals

[hubspot portal=”8484465″ id=”9e899409-3eaf-44a1-9bb6-ca3e08cd5743″ type=”form”]

Be First to Comment